Understanding Coverage: What Your Dental Insurance Really Covers

Introduction

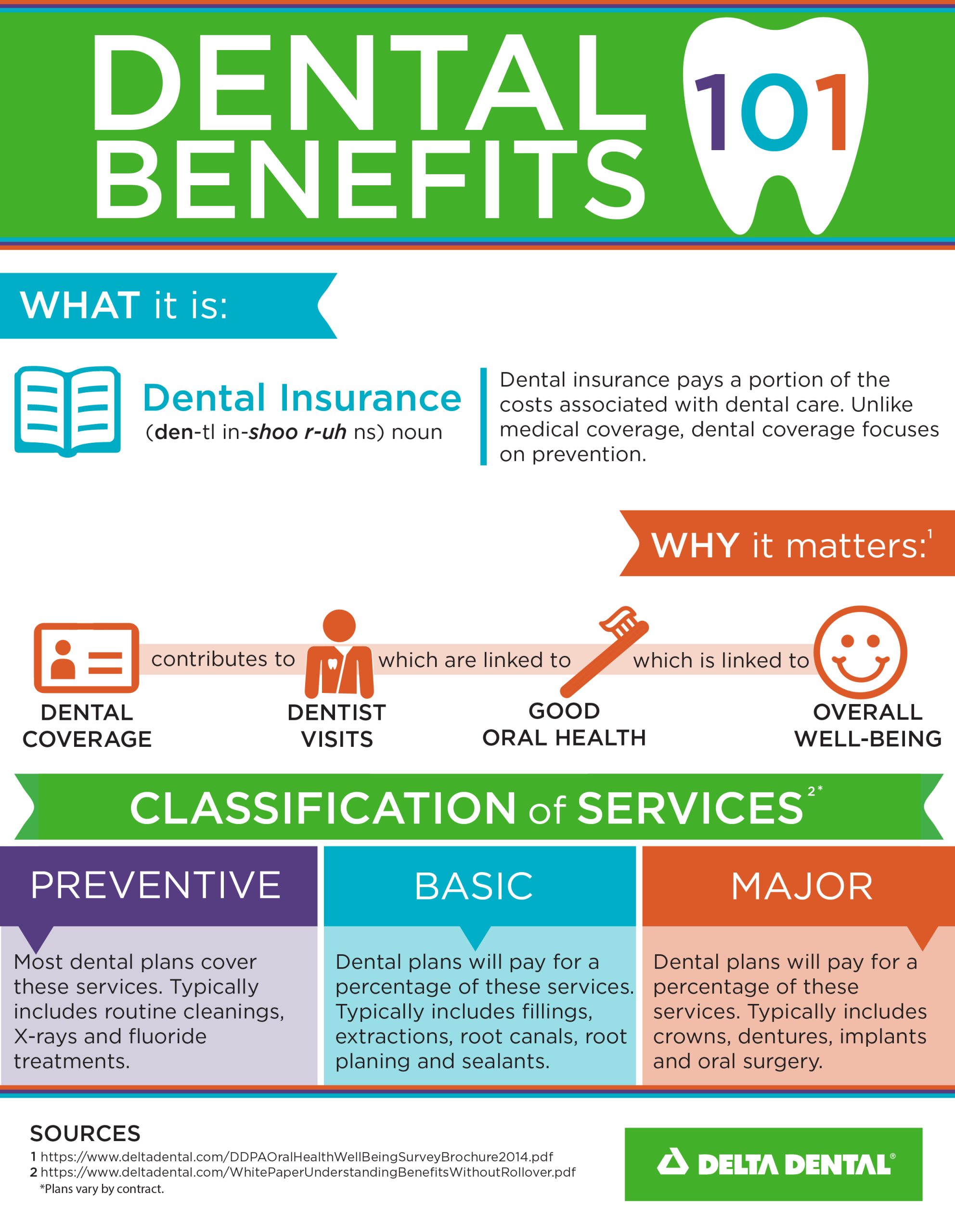

When it comes to dental insurance, understanding what is covered and what is not can be quite confusing. Many people assume that their dental insurance will cover all their dental expenses, only to find out later that certain treatments or procedures are not covered. In this article, we will delve into the details of dental insurance coverage, helping you gain a better understanding of what your dental insurance really covers.

Basic Dental Services

Most dental insurance plans cover basic dental services, which include routine check-ups, cleanings, and X-rays. These preventive services are crucial for maintaining good oral health and preventing dental problems.

Routine Check-ups

Regular dental check-ups are typically covered by dental insurance. These visits allow your dentist to examine your teeth and gums, detect any early signs of dental issues, and provide necessary treatments.

Cleanings

Dental cleanings, also known as prophylaxis, are usually covered by insurance. Professional cleanings help remove plaque and tartar buildup, reducing the risk of gum disease and tooth decay.

X-rays

X-rays are essential for diagnosing dental problems that are not visible to the naked eye. Most dental insurance plans cover routine X-rays, such as bitewing X-rays, which are typically taken once a year.

Restorative Dental Services

Restorative dental services are aimed at repairing or replacing damaged or missing teeth. While coverage for these services may vary depending on your insurance plan, most plans provide some level of coverage for restorative procedures.

Fillings

Fillings are used to treat cavities and restore the structure and function of the affected tooth. Dental insurance often covers a portion of the cost of fillings, although the coverage may vary depending on the type of filling material used.

Crowns

Crowns are used to cover and protect severely damaged or decayed teeth. Dental insurance plans typically cover a percentage of the cost of crowns, but it’s important to check the specific coverage details in your plan.

Summary

Understanding the coverage provided by your dental insurance is essential to avoid unexpected expenses and make the most out of your benefits. Dental insurance plans typically have limitations and exclusions that policyholders should be aware of. While basic preventive care such as regular check-ups, cleanings, and X-rays are usually covered, more complex procedures like orthodontics, cosmetic dentistry, or dental implants may have limited coverage or require additional out-of-pocket expenses.

It is crucial to carefully review your dental insurance policy to understand the specific coverage details, including deductibles, annual maximums, waiting periods, and any restrictions on certain treatments. Additionally, some plans may have preferred provider networks, meaning you may receive higher coverage or discounted rates when visiting in-network dentists.

By understanding your dental insurance coverage, you can plan your dental treatments accordingly, budget for any potential out-of-pocket expenses, and make informed decisions about your oral health. Regular communication with your dental insurance provider and dentist can also help clarify any doubts or questions you may have regarding coverage.

Remember, dental insurance is designed to assist with the cost of dental care, but it may not cover everything. Being get more proactive in understanding your coverage will empower you to take control of your oral health and make the most of your dental insurance benefits.

- Q: What is dental insurance?

- A: Dental insurance is a type of insurance coverage that helps pay for a portion of your dental expenses, such as routine check-ups, cleanings, fillings, and other dental procedures.

- Q: What does dental insurance typically cover?

- A: Dental insurance typically covers preventive care, such as routine exams, cleanings, and X-rays. It may also cover basic procedures like fillings and extractions, as well as major procedures like crowns, bridges, and dentures.

- Q: Are orthodontic treatments covered by dental insurance?

- A: Orthodontic treatments, such as braces or aligners, are not always fully covered by dental insurance. Some plans may provide partial coverage or have specific limitations and waiting periods for orthodontic procedures.

- Q: Does dental insurance cover cosmetic dentistry?

- A: Dental insurance typically does not cover purely cosmetic procedures, such as teeth whitening or veneers. However, if a cosmetic procedure also serves a functional purpose, such as a crown to restore a damaged tooth, it may be partially covered.

- Q: What is a deductible?

- A: A deductible is the amount of money you must pay out of pocket before your dental insurance starts covering the costs. It is usually an annual amount.

- Q: Are there any waiting periods for dental insurance coverage?

- A: Yes, dental insurance plans often have waiting periods before certain procedures are covered. Waiting periods vary depending on the insurance provider and the specific procedure.

- Q: Can I choose any dentist with dental insurance?

- A: Dental insurance plans may have a network of preferred providers. While you can still visit dentists outside the network, your out-of-pocket costs may be higher.

- Q: How often can I visit the dentist with dental insurance?

- A: Most dental insurance plans cover routine check-ups and cleanings every six months. However, coverage for additional visits or treatments may vary depending on the plan.

- Q: What should I do if a dental procedure is not

Welcome to my website! My name is Joshua Shoobridge, and I am a dedicated Dental Consultant with a passion for promoting oral health education, providing insights into cosmetic procedures, and offering valuable tips on dental insurance. With years of experience in the dental industry, I am committed to helping individuals achieve and maintain optimal oral health.

Introduction When it comes to dental insurance, understanding what is covered and what is not can be quite confusing. Many people assume that their dental insurance will cover all their dental expenses, only to find out later that certain treatments or procedures are not covered. In this article, we will delve into the details of…