Introduction

Are you confused about your dental insurance coverage? Don’t worry, you’re not alone. Navigating the world of dental insurance can be overwhelming, especially for beginners. Understanding the ins and outs of your dental insurance policy is crucial to ensure you make the most of your benefits and avoid unexpected costs. In this beginner’s guide, we will break down the key aspects of dental insurance coverage, explain common terms, and provide tips to help you maximize your benefits.

What is Dental Insurance?

Dental insurance is a type of insurance coverage that helps individuals manage the costs associated with dental care. It is designed to provide financial assistance for preventive, basic, and major dental treatments.

How Does Dental Insurance Work?

When you have dental insurance, you pay a monthly premium to the insurance company. In return, the insurance company covers a portion of your dental expenses, depending on the terms of your policy. The coverage typically includes preventive services, such as cleanings and exams, as well as restorative treatments like fillings and crowns.

Types of Dental Insurance Plans

There are different types of dental insurance plans available, including:

Indemnity Plans

Indemnity plans allow you to choose any dentist you prefer. The insurance company reimburses a percentage of the dental expenses based on a fee schedule or usual, customary, and reasonable (UCR) charges.

Preferred Provider Organization (PPO) Plans

PPO plans have a network of dentists who have agreed to provide services at discounted rates. If you visit a dentist within the network, you will have lower out-of-pocket costs compared to going out-of-network.

Health Maintenance Organization (HMO) Plans

HMO plans require you to choose a primary dentist from a network of providers. You must receive all your dental care from this dentist or obtain a referral to see a specialist. HMO plans generally have lower premiums but limited provider choices.

Coverage Levels

Dental insurance plans typically have different coverage levels for different types of treatments. These levels may include:

Preventive Care

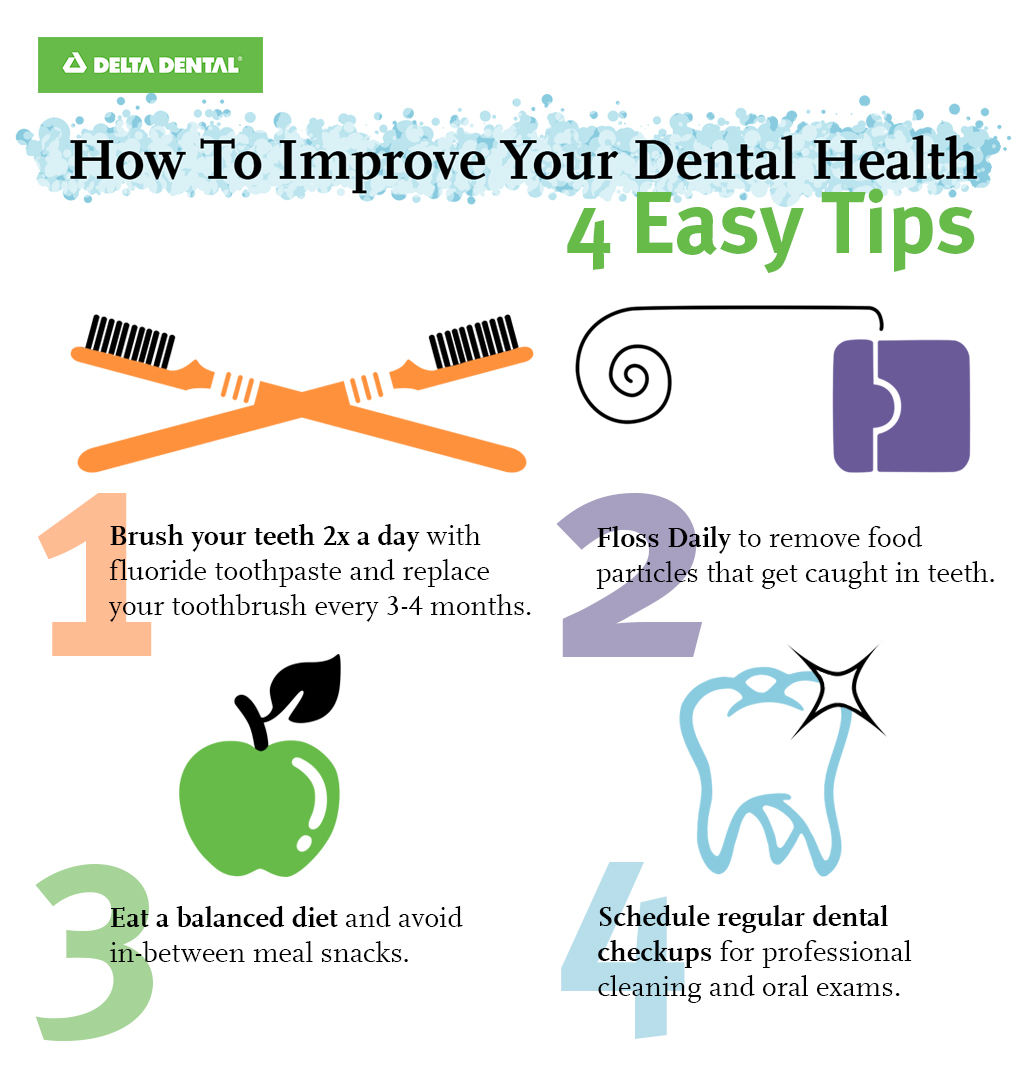

Preventive care includes routine check-ups, cleanings, and X-rays. Most dental insurance plans cover preventive services at 100%, meaning you won’t have to pay anything out-of-pocket for these treatments.

Summary

Understanding your dental insurance coverage is essential for maintaining good oral health without breaking the bank. This beginner’s guide aims to simplify the complexities of dental insurance, making it easier for you to comprehend and utilize your benefits effectively. By familiarizing yourself with common terms and concepts, you can make informed decisions about your dental care an see this site d avoid any surprises when it comes to costs. Remember, prevention is key, and regular dental check-ups are vital for maintaining a healthy smile.

- Q: What is dental insurance?

- A: Dental insurance is a type of insurance coverage that helps pay for dental expenses and treatments.

- Q: How does dental insurance work?

- A: Dental insurance typically works by paying a portion of the cost for dental services, such as cleanings, fillings, and extractions, after the policyholder pays a deductible.

- Q: What does dental insurance usually cover?

- A: Dental insurance usually covers preventive services like cleanings and X-rays, basic procedures like fillings and extractions, and sometimes major procedures like root canals and crowns.

- Q: Are there any limitations or exclusions with dental insurance?

- A: Yes, dental insurance may have limitations or exclusions such as waiting periods, pre-existing condition clauses, or coverage restrictions on certain treatments.

- Q: How do I find out what my dental insurance covers?

- A: To find out what your dental insurance covers, you can review your policy documents, contact your insurance provider directly, or ask your dentist’s office for assistance.

- Q: Can I choose any dentist with dental insurance?

- A: It depends on the type of dental insurance plan you have. Some plans allow you to choose any dentist, while others require you to visit dentists within a specific network.

- Q: What is a deductible?

- A: A deductible is the amount of money you must pay out of pocket before your dental insurance starts covering a portion of the costs.

- Q: Is dental insurance the same as dental discount plans?

- A: No, dental insurance and dental discount plans are different. Dental insurance provides coverage for dental services, while dental discount plans offer discounted rates for dental treatments.

- Q: Can dental insurance cover cosmetic procedures?

- A: Dental insurance typically does not cover cosmetic procedures like teeth whitening or veneers, as they are considered elective treatments.

- Q: What should I do if my dental insurance claim is denied?

- A: If

Welcome to my website! My name is Ben Stout, and I am a dedicated and passionate Dental Hygienist with years of experience in the field. I am thrilled to share my knowledge and expertise with you through this platform.

As a Dental Hygienist, my primary goal is to ensure optimal oral health for my patients. I firmly believe that a healthy smile is not only aesthetically pleasing but also crucial for overall well-being.